The recent labor shortage in the U.S. is an unexpected side effect of the pandemic that has left seasoned economists mystified and small businesses empty-handed. It also shone a light on the need for an optimized back office that can allow companies to navigate uncharted waters without shuttering their doors. While no business could ever predict the long-term economic aftershocks of a pandemic that has infiltrated daily life in such an unprecedented fashion, there are those that have come up on the other side stronger than before. The difference between these businesses lies in their preparedness for such disasters, as well as their willingness to adopt more efficient technologies that automate daily back office workflows.

An unforgiving labor market has left small businesses short-handed

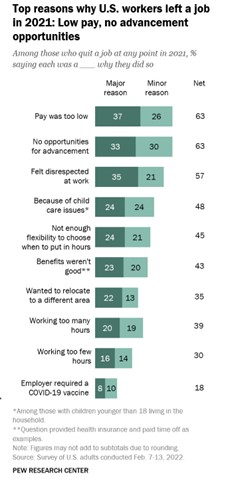

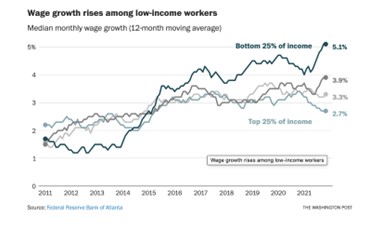

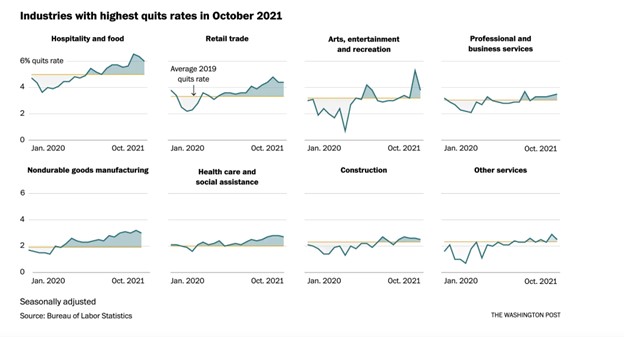

No one could have predicted the long-term effects of the pandemic on the labor market. While many expected working life to return to pre-pandemic conditions, the bar shifted in the opposite direction, and laborers left the workforce in droves. Labeled “The Great Resignation,” the U.S. Bureau of Labor Statistics stated that over 47 million Americans voluntarily quit their jobs. While the reasons were varied, low pay and few opportunities for advancement were cited as top reasons, according to the Pew Research Center. Additionally, minimum wage and labor costs have risen. If small businesses can find talented workers, they break the bank. A recent Washington Post article states that “This worker power has translated into the highest wage gains workers in nonmanagement positions have seen in almost four decades… Across the economy, lower pay has tended to mean higher wage growth. Nonmanagerial workers in gas stations, the lowest-paid subsector, saw earnings rise 15.9 percent (to $14.58) since the pandemic began. That’s far above the 10.2 percent increase seen by the average nonmanagerial worker over that time.”

Small businesses in the wake of the great resignation

Today, the resignation trend is still strong, unemployment rates are low, and it’s leaving small businesses without skilled labor. Additionally, small businesses have long relied on workers to show up to the office. But the pull toward remote work and better life balance outweighs the benefits of signing on to office life again. Given this lack of trustworthy manpower to lift up small businesses, they are often unprepared for opportunities that may help them stay afloat. During the pandemic, an opportunity for government grants and PPP loans were offered to those businesses that could provide updated bookkeeping and accounting reports. Many small businesses failed this test due to neglected bookkeeping practices. Accounts were not kept up to date properly, likely due to lack of skilled labor, as well as the common practice of prioritizing customer-facing roles. In short, back office work flows, such as keeping the books in line, were prioritized last.

The accounting industry is seeing an unprecedented reduction in the workforce. Many seasoned accountants are retiring, and powerful software advancements have created an education and experience barrier that requires that entrants into the field hold a CPA license. This lack of seasoned accountants has left small businesses in a precarious position. Out of date reporting leaves business leaders questioning their next steps, and leaves the entity itself at risk. Mistakes happen easily when no one is keeping up the back office. In one instance during the pandemic, a well-known boutique hotel without the appropriate back office staffing missed specific vendor payments. The water was shut off, leaving guests and hotel staff without running water. This nightmare scenario, and many others, are easily avoidable when the appropriate back office automations are in place.

Easy small business solutions for an optimized back office

Within five years, successful small businesses will be running on top of digital autonomous work flows. What does this mean? Manual back office work flows like data entry, vendor payment, revenue tracking, and account reconciliation will be automated by AI-driven technologies. Real-time reporting capabilities will allow small business owners to make effective decisions faster. Spend controls will be optimized, and unnecessary expenses will be eradicated. Opportunities like government small business grants and PPP and EIDL loans will not be missed, because the reporting tools will provide accurate information – a powerful and valuable incentive for any business owner. The workforce will be repurposed to more valuable positions, and business owners will be able to afford to incentivize them through commissions.

While the recent economic conditions have been a great challenge for small businesses, the long-term benefits of operating efficiently with accounting automation will be liberating. Business owners will have the ability to view real-time reporting and see their business’ big picture at a glance. This will allow them to make decisions faster and grow at a healthy pace. They will have spend control and an optimized back office that will allow them to hire more valuable skilled labor. And most importantly, they will be able to navigate economic fluctuations with ease, which will ensure the future health of their business.

Sid Saxena is the CEO and cofounder of Docyt, an accounting automation software platform. It’s a single system, which uses machine learning, to automate all financial workflows – both income and expense side – and provides real-time ledger reconciliation and financial statements. For the first time, real-time financials are possible through Docyt.

Technology stock image by TippaPatt/Shutterstock