The financial landscape has shifted and signs of a looming economic downturn are everywhere. According to Conference Board’s data, there is a 99% chance of a recession in 2023.

American consumers have seen public stock take an early hit and corporate earnings are coming down.

These headlines are emblematic of what’s going on in enterprises and public companies, but Main Street isn’t feeling the heat just yet.

Recessions don’t impact all businesses the same way or at the same time. Small businesses are currently fairing better than large corporations:

- Small business job numbers are strong – making up 78% of all U.S. job listings.

- Unemployment rates remain low – currently at 5%.

- Inflation hit a 2022 low at 6.5% in December – down from 9.1% in June.

However, cash runway for small businesses is already pretty tight. Costs are increasing and money is getting more expensive. Interest rates have gone up eight times this year.

That’s why even if small business owners are feeling a bit removed from the anxiety of a recession right now, they see what’s coming next.

By being financially strategic day-to-day and week-to-week and leveraging technology to keep operations afloat, small business owners who made it through the challenges of 2020 won’t have to go through that journey again. Here are four ways to recession-proof your small business in 2023.

Track your cash flow

U.S Bank’s study reveals that 82% of failed businesses struggled due to an inadequate understanding or mismanagement of their financial resources.

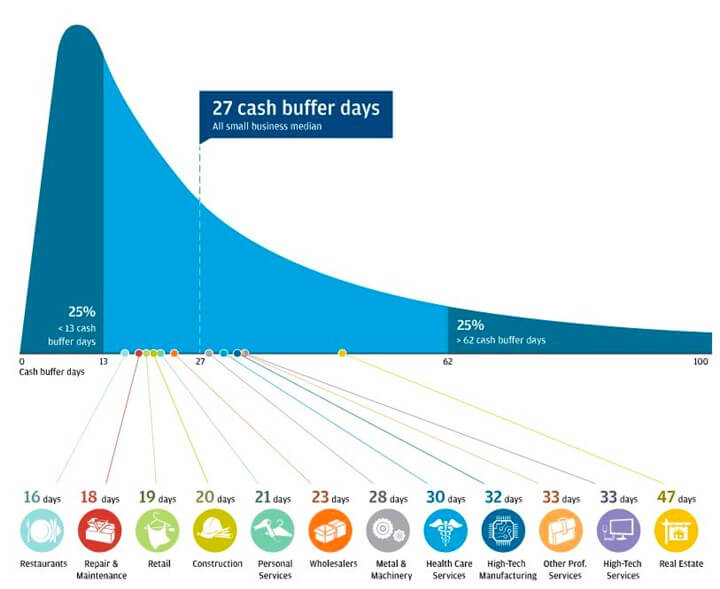

Most SMBs have a cash buffer of 27 days. Proper planning and tracking your money are essential for long term success.

This one was critical for our own business. One of the first things we did in early February 2020 was build a cash tracker that forecast how much cash we would be receiving in the next 30 days. Using this data, we were able to do a lot of planning and get ahead of hard financial decisions, such as asking management and owners to take a pay cut to get through this period.

Today most accounting software or small businesses online banking portals can provide a similar projection—typically called a “cash flow management” feature.

Shore up your credit lines

Nearly a third of small businesses are unable to stay afloat due to inadequate capital. That’s why having a good banking relationship is key, especially in uncertain times, to secure your financial future.

If you already have access to credit lines, inquire with your bank about increasing it today – so you can be prepared for tomorrow.

Additionally there are far more sources of credit available to small businesses—from technology solutions like your Point of Sale system to your accounting software—which are fairly accessible, if you do not have a dedicated banking relationship.

Negotiate for extended payment terms

The pandemic caused a seismic shift for small businesses, pushing them to reassess how they paid their vendors. Traditional net 30 day payment terms evolved into longer net 90 day terms.

Negotiating payment terms with your vendors is a really smart thing to do right now: check if your top vendors can extend your payment terms out 15, 30 or more days than usual.

During normal times this is a very prudent practice, as extra time can improve your cash conversion cycle—potentially driving it negative could unlock growth for your business.

Leverage technology to run and grow your business

Think back to how restaurants operated in 2008. A lack of the right tech forced many establishments to close their doors forever, or got really close to having to.

Poor inventory management, the second biggest cost for SMBs at 17% – 25%, led to lots of waste and spoiled food.

Workforce management was also a challenge. Labor makes up 70% of a restaurant’s spend. However, without the right tools to quickly identify strong candidates, restaurant managers either got buried under resumes or made rushed hiring decisions, which led to high turnover. A lack of full staff coverage ultimately can lead to poor guest experiences and costly bad reviews.

Now, SMBs are leveraging technology to run their businesses operations and hire staff more efficiently. The U.S. Chamber of Commerce shared that 93% of small business owners are already leveraging at least one platform to help their operations. 85% say these tools helped put their businesses on the right path, while an impressive 94% say it makes running a business easier than ever before.

Despite how a wealth of tools and data can predict an oncoming recession, some economists are saying, “The signals are mixed in a way that we haven’t seen before.” That’s why it’s critical that small business owners are taking the right steps to recession-proof today for an uncertain tomorrow.

Sid Upadhyay is the CEO and Co-Founder of Wizehire, a leading hiring platform that helps small businesses grow with a better way to hire. Since 2014, Wizehire has focused on a future where small businesses can attract and win the same high level of talent as big companies. The hiring platform gives business owners an applicant tracking system, expert advice from dedicated hiring coaches, and recruiting resources like job ad templates and personality assessments to pre-screen candidates that save them time and money and help them hire the right candidate every time. Over 15,000 employers choose Wizehire as the trusted advisor to help grow their business.