It’s 2022 and we are still talking about supply chain disruptions – slow deliveries, trucking and logistics issues, and worker shortages. The problems experienced in this industry have made front-page headlines for longer than most executives had anticipated, but they did not start with a worldwide pandemic, and disruptions in one form or another will certainly continue even when the pandemic is over. In 2021, supply chain disruptions cost the United States an average of $228 million with a serious impact on other countries globally. Credit insurance company Allianz Trade Credit Insurance also reported that logistics bottlenecks are impacting 25% of international trade volume. In fact, KPMG says there is a likelihood emerging that logistics disruptions will continue well into 2022 and beyond.

Building resilience into the supply chain can significantly mitigate the financial impact of disruption. However, this can be more challenging for small and medium-sized businesses (SMBs). In order to have liquidity to continue to grow and maintain operations in the face of supply chain disruptions, SMBs need payment solutions tailored to their size and needs.

The working capital struggle of international trade

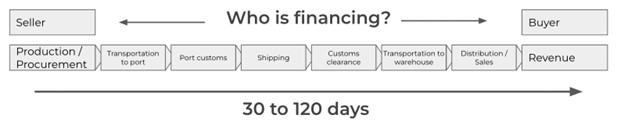

International trade is inherently a working capital struggle. Lead times from production to distribution can be extensive, and uncertainty makes the struggle even more difficult because of the unknowns that can’t be planned for.

It is very common for sellers to invest upfront in raw materials, labor, and manufacturing to produce their goods. If they have leverage with their buyer, then maybe they can get paid upfront prior to production. But early payment is uncommon. It is more likely the seller is getting paid when the buyer receives the goods, or even 90-120 days after receipt.

During supply chain disruptions, the timeframe between the seller and the buyer can increase tremendously, even upwards of 450 days. These disruptions increase payment delays and can cause serious financial problems for SMBs.

The financing gap

The solution to eliminating the struggle and financing the flow of trade is for one or more of the parties involved in the transaction to finance the deal. This financing can take many forms, from traditional lines of credit to invoice factoring, the seller’s balance sheet, or even dynamic discounting from a buyer’s own balance sheet.

If financing was accessible to all businesses, irrespective of size, credit history, or industry, then there wouldn’t be a working capital struggle. However, access to financing can be difficult and many SMBs find themselves not able to access the financing they need. According to an Asian Development Bank (ADB) study, rejection rates for trade finance reached record highs in 2020, with the gap between demand and supply currently at $1.7tn, a 15% rise compared to the previous estimate of $1.5tn in 2018.

The ADB’s latest research reiterates findings from previous studies that the trade finance gap disproportionately affects smaller enterprises, which are also strongly affected by the supply chain disruptions. Approximately 40% of rejected trade finance requests were from small and medium-sized businesses.

The challenge to access financing only intensified during the COVID quarantine, when many banks closed their branches to reduce physical contact dangers. Over 55% of SMB operations surveyed say the pandemic has strongly affected their business operations” following the COVID-19 outbreak, particularly in China, the EU, and the US. In addition, while many US businesses have good relationships with their local banks, they aren’t able to get proper cross-border or international funding from them. SMBs need help from businesses who provide financing and have an international aspect to their business, such as local offices around the world and the ability to handle transactions in multiple currencies. It can be especially tough when a seller’s local bank excludes foreign accounts receivable (A/R) from its borrowing base, even though they may have a great relationship with their bank.

How new digital platforms are addressing the struggle

Digitization of international business payments is expected to reduce the trade financing gap through greater operational efficiencies, reduction in complexity for the buyer and seller, and access to a more comprehensive dataset for underwriting. The creation of digital platforms for business payments, including trade finance, will enable more buyers and sellers flexible payment solutions that optimize balance sheets and mitigate supply chain risk affecting cash flow. These digital payment solutions remove the paperwork, hassle, and red tape that hamper those involved in international trade, giving them access to the working capital and risk protection they need to thrive.

Digital platforms for global payments facilitate international trade for SMBs by maximizing their working capital and can help a business secure additional financing in a matter of days. One of the financing products available on these platforms is non-recourse invoice factoring that can help solve the working capital struggle for SMBs. Non-recourse invoice factoring is where a payment method partner, the factor, acquires the invoice while also providing credit risk protection if the buyer defaults. In the past, access to non-recourse invoice factoring has been slow, involved a lot of paper handling, and was not accessible to either SMB sellers, or to sellers whose buyers are also SMBs. Digital payment platforms have revolutionized how some financing options, such as non-recourse invoice factoring, can be secured by a wider range of businesses. Non-recourse invoice factoring is especially helpful as a supplement to sellers who already have a banking partner who isn’t able to handle their foreign A/R needs. Invoice factoring enables the seller to be paid early, which means credit terms can be given that help buyers and sellers outlast disruptions.

When working capital isn’t such a struggle, the result is growth

One case we saw first hand was a leading agricultural commodity firm with multiple locations across the U.S. that could experience considerable growth if they could solve their working capital struggle. The firm received a large and time-sensitive order from a long-time buyer in Denmark, but the buyer needed more time to pay to bridge the container shipping period. Before having a financing solution, the seller required payments to be made upfront in full before shipment could take place, but this requirement limited growth and collaboration between the two companies..

By using a digital payments platform, the U.S. seller could use non-recourse invoice factoring to offer their buyer up to 120 days post-shipment credit terms. The solution provided the company with additional working capital and credit protection it needed to capitalize on this large growth opportunity with its Danish buyer. Even though there are financing costs involved, the deal is mutually beneficial; the seller can continue to pay its farmers in cash, while their buyer can access credit terms that bridge the container shipping period. Without financing, there would have been no opportunity for top-line revenue growth of either party.

In another case we saw, the same struggles with working capital were preventing growth. The seller’s existing lender, a domestic bank, wasn’t able to cover their export business as they didn’t want the foreign A/R exposure. The inability for the seller to draw on their existing line of credit meant the seller would have to dip into their capital on hand to finance a growing segment of their business. However, like many businesses, the seller has a peak season, when the organization sells the most goods, so they don’t have enough cash on hand to finance the payment terms on their own. In this instance, the peak season was August/September, when they shipped goods to their customers in the run-up to the Christmas season.

The payment terms dictated by the buyer meant the seller wouldn’t get paid until 90 days after the goods were shipped, putting considerable stress on the seller’s cash reserves. In 2021, the pressure was particularly severe as disruptions in the shipping industry and COVID insecurity meant buyers were buying more than ever to ensure they had adequate stock to cover this crucial selling period. The rapid growth in orders added to their already unfavorable position. Given it was peak season, they needed a solution fast, and a non-recourse invoice factoring solution, delivered 100% digitally in a short period, enabled them to handle the unexpected ramp-up in order volume, as well as to manage the uncertainty of the time it might take to get paid because of supply chain challenges. In addition, a digital payments platform enabled the buyer and seller to be underwritten based on data points existing on the platform, speeding up the underwriting process. As such, the seller could conduct the trade with no physical documentation required, and they could manage the entire process on the platform, including tracking their shipments. Most importantly, they were paid as soon as they shipped the goods, allowing them to fulfill additional orders and grow their export business.

Looking forward

International trade plays an essential role in boosting consumer choice, providing new employment opportunities, and raising living standards. Regulatory and financing issues continue to hamper the ability of organizations to seize their international opportunities across a range of industries – from manufacturing to agricultural commodities.

Small and medium-sized businesses are critical players in the future of the global economy, but they face the biggest struggle securing financing. Unfortunately, many companies have already succumbed to bankruptcy due to pandemic-related systems and supply chain financing failures. As such, innovative solutions to business payments are necessary to eliminate the massive gap between those who need trade financing, and those who can currently access it.

Buyers and sellers across the globe are beginning to recognize the advantages of adopting a technology-based infrastructure as a significant ingredient to their growth. Bridging the digital divide will support economic recovery after the pandemic and ensure that trade is less vulnerable to future disruptions. Digital payments platforms are one of the most important trends in technology for trade, and create a foundation for economic growth by offering tools that can help businesses reduce their credit risk, forecast cash flow, allocate working capital, and explore a more broad customer and supply base. With the ultimate outcome of not only eliminating the working capital struggle, but turning business payments into a tool for growth.

Luke Tuttle is the General Manager of North America and Trade Management Services at MODIFI. MODIFI is helping sellers grow their business through innovative solutions in global payments, trade financing, and trade management services. Contact us today to discuss your challenges with either your current exports, or with ideas for how we can help grow your business through faster access to working capital.

International trade stock image by Net Vector/Shutterstock